In result, when an employee pays down a college student loan, the employer is permitted to match it with the things they’re contributing being an employer match to their retirement plans for instance a 401(k). Which allows and incentivizes new graduates to pay for down their loans without sacrificing cost savings.

The account proprietor can change the beneficiary into a parent and use this to repay approximately $10,000 of dad or mum education loans also. If Each individual mother or father has borrowed dad or mum loans, the account operator can alter the beneficiary from one mother or father to the other to pay off that father or mother’s schooling loans.

Refinancing and fairness guideToday's refinance ratesBest refinance lenders30-year preset refinance rates15-year fixed refinance ratesBest cash-out refinance lendersBest HELOC Lenders

On the other hand, using a pay as you go tuition system, the supplier or perhaps the plan (ordinarily the point out or College) bears the chance linked to the plan. Only nine states offer you pay as you go tuition options plus they depict about eight% of school savings while in the U.S.

Any time you generate a withdrawal, You might also have to select regardless of whether you’re utilizing the revenue for bigger instruction expenditures, like college or trade faculty, or for those who’re working with it for K-12 expenses, like tuition for A non-public or parochial school.

Conditions and terms implement. Loan or personal savings calculators are provided for your personal use and the outcomes are based upon the data you present. The final results of the calculator are only meant as an illustration and they are not sure to be exact. Precise payments and figures may perhaps range. Splash Fiscal loans are offered by means of preparations with lending associates. Your loan application will be submitted into the lending husband or wife and become evaluated at their sole discretion. For loans in which a credit union is the lender or a purchaser of your loan, in an effort to refinance your loans, you have got to become a credit history union member. The Splash Scholar Loan Refinance Plan isn't provided or endorsed by any university or College. Neither Splash Economic nor the lending companion are affiliated with or endorse any higher education or university listed on this Web page. You ought to critique the advantages of your federal university student loan; it might present particular benefits that A non-public refinance/consolidation loan might not provide.

Homeowners coverage guideHome insurance policy ratesHome coverage quotesBest house insurance plan companiesHome insurance policies and coverageHome insurance policy calculatorHome insurance evaluations

Taxes are the only accountability with the recipient. You will find a Restrict of 1 bonus per borrower. This give isn't legitimate for latest ELFI customers who refinance their present ELFI loans, clients who have previously been given a reward, or with almost every other bonus delivers acquired from ELFI by using this or any other channel. Should the applicant was referred using the referral bonus, they won't obtain the reward supplied by means of the referring celebration. If the applicant results in being an ELFI purchaser, They could be involved in the referral bonus by becoming the referring bash. More terms and conditions utilize.

Alter website the beneficiary. You may change the beneficiary of a 529 intend to an suitable relative of the initial beneficiary — such as a sibling, initial cousin, or mother or father.

7 states don't have a private revenue tax. Consequently, they don't Possess a point out deduction or credit score option on contributions:

This means that when They can be treated the same for federal taxes, point out tax treatments can vary. Each individual state presents various strategies with their own financial commitment alternatives, and you also do not need to use your own home condition’s approach.

NerdWallet will not invest its dollars with this company, but They may be our referral partner – so we get paid only if you simply click via and take a qualifying motion (which include open an account with or present your contact data into the provider).

Considering that the program’s earnings accumulate tax no cost, withdrawals are federally revenue tax free and penalty cost-free, as long as They may be utilized for qualified higher education and learning expenditures.

“If you can obtain sponsored college student loans – loans that don’t accrue interest right up until When you’ve graduated – then it could make sense to take subsidized loans then Enable your 529 approach develop after a while all through university,” says Joyce.

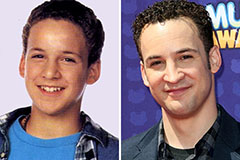

Ben Savage Then & Now!

Ben Savage Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Heath Ledger Then & Now!

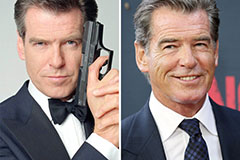

Heath Ledger Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!